Debt Consolidation is a scam - Debt Elimination is the Winning strategy to get out and stay out debt for life!

One dollar of debt is one dollar too many. Billions of people are in debt, and they are looking for credible advice to shed their debt loads.

The financial industry (Mortgage Brokers and Lenders) pushes debt consolidation as a life-changing strategy. Most of the debt consolidations prescribed by Banks and Mortgage Brokers are refinancing people’s mortgages to consolidate their debt.

An unsecured debt consolidation loans are hard to come by.

They are helping people convert their unsecured debt to secured debt. Debt consolidation, in most cases, improves the client’s monthly cash flow but does save the client any money. On the contrary, the client’s waist closing cost and consume some of its home equity every time they refinance.

A client rarely refinances its mortgage to consolidate its debt and shrinks the amortization period. On the contrary, most of them reset their amortization back to 30-yeas

Time has Come To Embrace Debt Elimination Strategies Instead Of The Failed Debt Consolidation Strategy That The Financial Industry is dispensing as aspirin!

The most touted debt consolidation strategy is failing the mass – if I can influence you, do not fall for the myths of debt consolidation.

The sad news is too many people are failing with their debt consolidation efforts. The financial industry and its stakeholders are earning an obscene amount of money in interest and fees. The people who participate in consolidating their debt improve their cash flow and do not save money. Improving cash flow is different from savings money – this is where the public is misled.

Statistics Canada, in September 2016, reported the state of household debt during the second quarter. The ratio of household debt-to-disposable income is 179% – meaning households hold more than $1.79 in debt for every dollar of annual disposable income.

US household debt load is creeping back up, and student loans are ballooning despite a serious decline since the 2008-2009 recession. American household debt is almost at the pre-recession level.

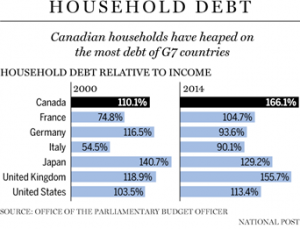

The picture is grim for many households in the industrialized world. Here is a snapshot of the debt load they are carrying.

I want to challenge the industry – Banks, lenders, private lenders, mortgage brokers, loan originators, debt elimination advisors to closely look at how they deal with clients’ debt and the debt consolidation loans they are dispensing.

All these stakeholders have one goal and one goal only – their goal is to sell products, e.g., mortgages, debt consolidation loans. The lenders earn interest and fees on their money, and the mortgage broker makes its commission.

Please understand I am not baching banks, lenders, and mortgage brokers, and they provide a service. I am bashing the debt consolidation strategy and alerting the public.

People think they can become debt-free using Debt consolidation as a strategy, and debt consolidation has failed the mass.

They need to eliminate their debt. The only way to do that is to eliminate their debts – debt consolidation prolongs the debt struggle and makes things more expensive.

Debt consolidation loans are marketed as the solution to get out of debt. The debt consolidation strategy is misleading the public.

The answer!

A new industry is gaining momentum daily – that industry is money coaching.

Money coaches are coming to the table and asking daring questions no one dared or cared to ask in the past. The questions are:

- Why do people do what they do with their money?

- What makes one person thrive financially while another continually struggles?

Money coaches understand that the subconscious money beliefs of each person dictate why each person does what they do with their money. And the answer goes beyond the numbers in each person’s life. Many books are written on this topic.

Money coaches also focus on putting financial plans in their clients’ lives to gradually help them gain control over their money to achieve peace and prosperity.

Money coaches are a big advocate to stop looking at a product, e.g., debt consolidation loan, mortgage your property to pay off your debt as a solution.

They offer a different solution to people’s money problems – they personalize comprehensive financial plans to help their clients gain control over their money issues. They are using the product as an integral part of a solution.

Money coaches create, implement, and monitor comprehensive financial plans for their clients. The money coach is helping their clients integrate their goals, income, expenses, liabilities, mortgage(s), investment(s), and insurance into an overall financial plan to:

- live within a balanced budget that works,

- successfully manage their home equity (if the borrower is a homeowner)

- execute the appropriate debt eliminate strategy to help their clients become debt-free and stay debt free for life,

- improve their cash flow and liquidity

- create wealth

- maximize tax deductions (if applicable)

If you want to restructure your financial house and put the above value in your life, you benefit greatly from working with a seasoned Money Coach to put the right plan for your money.

Click here to book your FREE 30-minute money coaching session to discover your options.